- Turn everyday purchases into unlimited Points with 5% Back in Points1 on Ford Dealership Purchases, 3% Back in Points1 on gas, auto insurance, tolls, parking & dining, and 1% Back in Points1 on All Other Purchases

- 10% Back in Points1 on Ford Service — That’s 5% Back in Points on Ford Dealership Purchases plus 5% Back in Points with FordPass Rewards

- Redeem FordPass Rewards Points toward discounts on Ford Purchases like your next Ford Vehicle Purchase, Ford Parts, and Ford Service and Maintenance

- Earn 11,000 FordPass Rewards Points1 after your first purchase.

- Earn a $100 Statement Credit1 when you spend $3,000 within your first 3 billing cycles after your account is opened

- Get Everyday Special Financing and enjoy 0% APR2 for 6 billing cycles from the date of purchase on Ford purchases over $499. After your 6 billing cycles expire, you’ll have a variable APR rate of 25.74%–31.24% based on the Prime Rate depending on how you meet our credit criteria.

- Every year, earn a $200 Annual Statement Credit1 when you spend $6,000 in 12 consecutive billing cycles from account opening

- No Annual Fee2

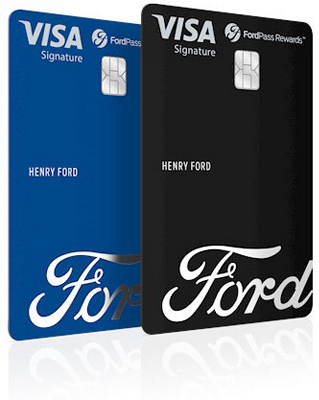

Driving home more FordPass Rewards Points for your Ford

-

-

Must apply here for this offer. Offers vary elsewhere*

Additional Features

Fraud Protection

We continuously and proactively scan your transactions, flagging anything that seems out of place. If suspicious activity should arise, we’ll contact you to resolve the situation.

Zero Liability3

Automatically Our 24/7 guarantee that you won't be held responsible for fraudulent charges made with your card or account information.

Roadside Dispatch®

Provides 24-hour access to roadside assistance like tire changing, jump starting or towing. The fees for this pay-per-use service are pre-negotiated and available exclusively to Visa cardmembers.

*Offers may vary depending on where you apply, for example online or in person. To take advantage of this offer, apply now directly through this advertisement. Review offer details before you apply.

FordPass Rewards Visa® Important Information

Please see the FordPass Rewards Visa Summary of Credit Terms for important information on rates, fees, costs, conditions and limitations.

Please note you must pay your entire statement balance (with the exception of purchases made with this promotional rate during its promotional rate period) in full by the payment due date each month to avoid being charged interest on new non-promotional purchases from the date those purchases are made.

Special Financing Offer Details: Purchases in which single or multiple items are purchased in the same transaction totaling at least $499.00 at Ford dealerships will be referred to as "Eligible Purchases" in your Summary of Credit Terms. All transactions are subject to approval. Accounts are eligible only if they are open, in good standing and not already subject to special terms. All other terms of your account remain in effect. Minimum Monthly Payments Required

1 See the FordPass® Rewards Visa® terms and conditions in the Summary of Credit Terms. Points are not redeemable for cash or check, and have no monetary value. Please see the FordPass® Rewards Program Terms and Conditions for information regarding expiration, redemption, forfeiture, and other limitations on FordPass Rewards Points. Must have an activated FordPass Rewards account to receive FordPass Rewards Points.

2 For additional information about Annual Percentage Rates (APRs), fees and other costs, please see the Summary of Credit Terms.

3 Visa's Zero Liability policy covers U.S. issued cards only and does not apply to PIN transactions not processed by Visa or certain commercial card transactions. Cardholder must notify issuer promptly of any unauthorized use. Consult issuer for additional details or visit www.visa.com/security.

Cards are issued by First National Bank of Omaha (FNBO®), pursuant to a license from Visa U.S.A. Inc. Visa is a registered trademark of Visa International Service Association and used under license.